J.B. Falgoust Department of Accounting & Finance

DEPARTMENT MENU

If you are interested in a career in finance, the J. B. Falgoust Department of Accounting & Finance is the right place.

Here are a few reasons why you should pursue a degree in finance or financial services marketing at the J. B. Falgoust Department of Accounting & Finance at Nicholls:

- Quality. The Nicholls College of Business has been accredited by AACSB International for the last 30 years. Hence, our degree plans and finance courses meet the stringent educational requirements set forth by AACSB for a bachelor’s degree.

- Student Focused. The department provides opportunities for students to interact with faculty, other students and members of the profession.

- Dedication. The faculty and staff of the department are dedicated to helping you achieve your career goals.

- Employment. The finance and financial services marketing degrees offer many fascinating and rewarding careers for young professionals.

Peruse our website to find out more about our curriculum, faculty members, student organizations and career opportunities. Come learn, live and lead with a degree in finance or financial services marketing from the Nicholls College of Business Administration.

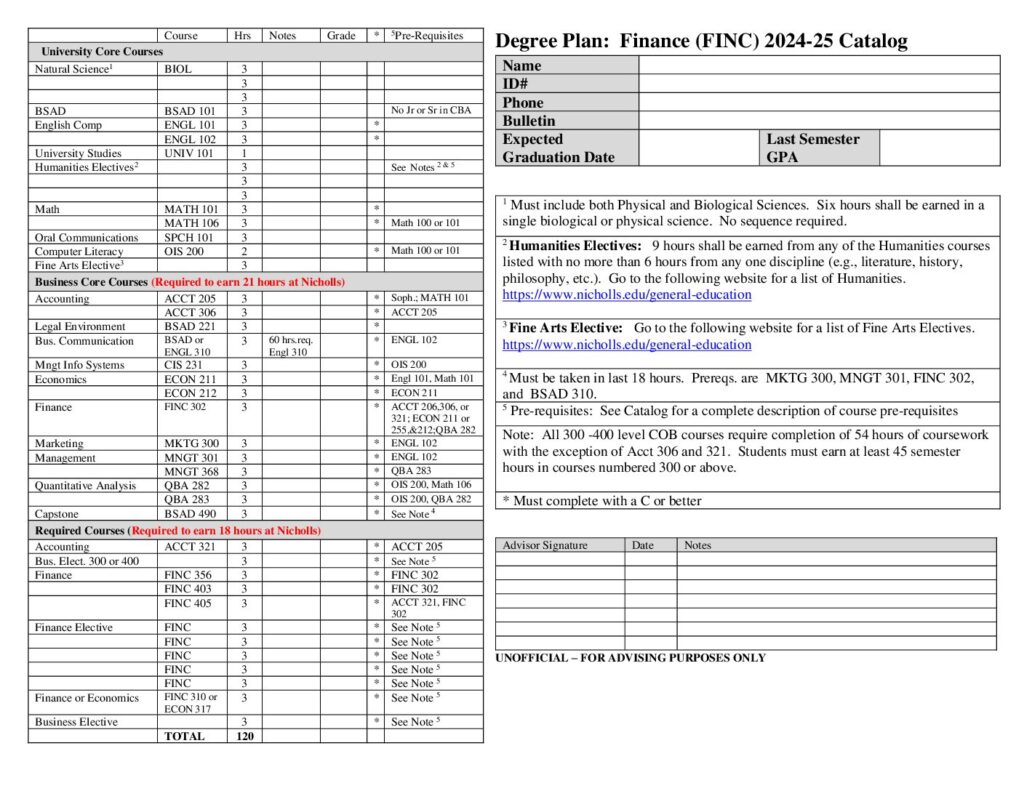

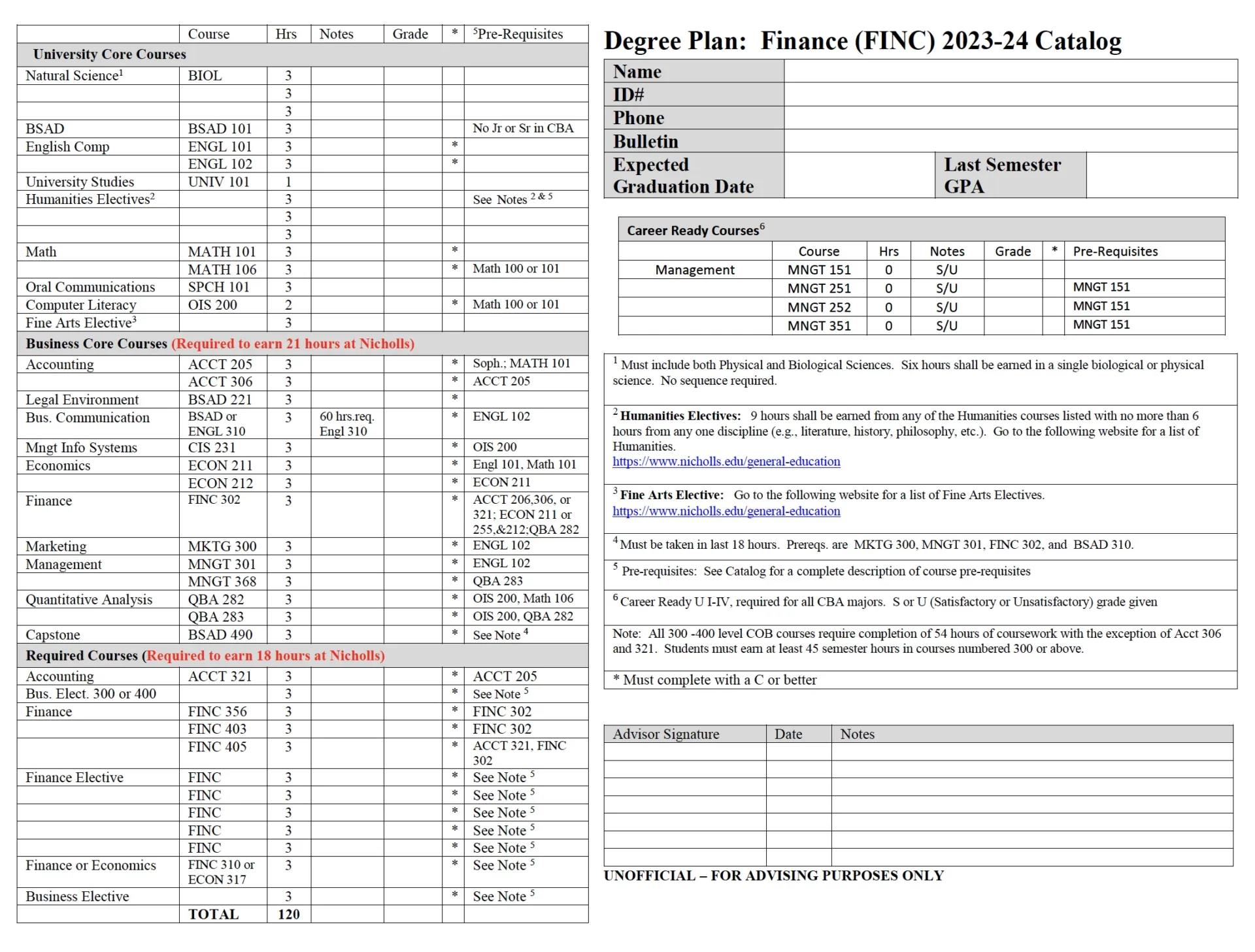

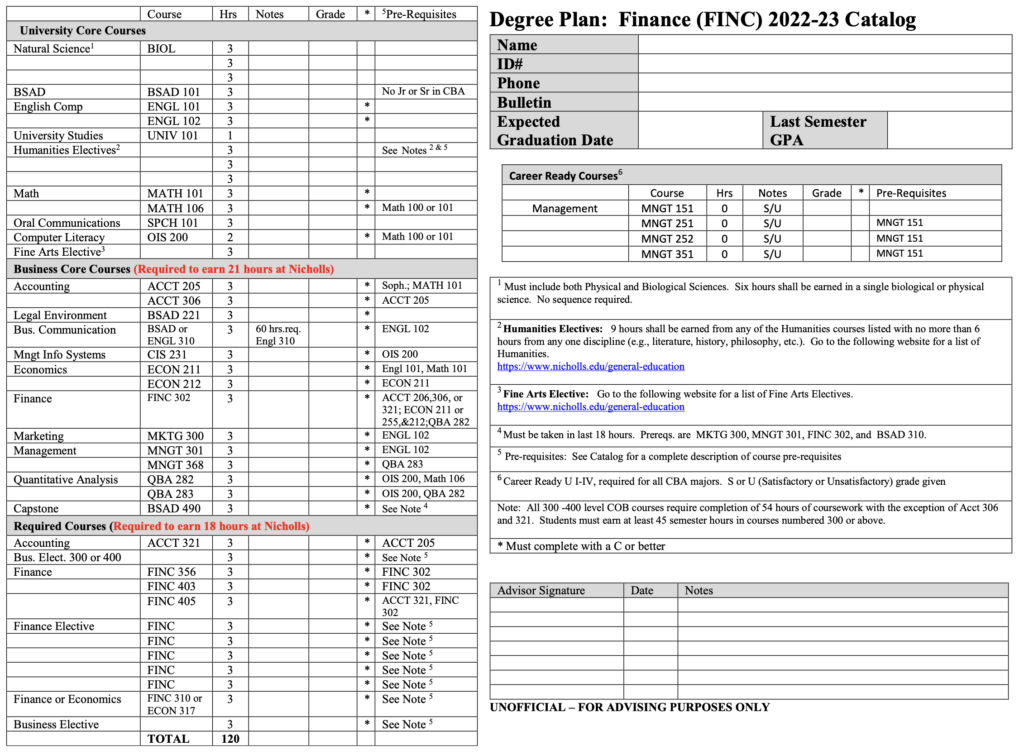

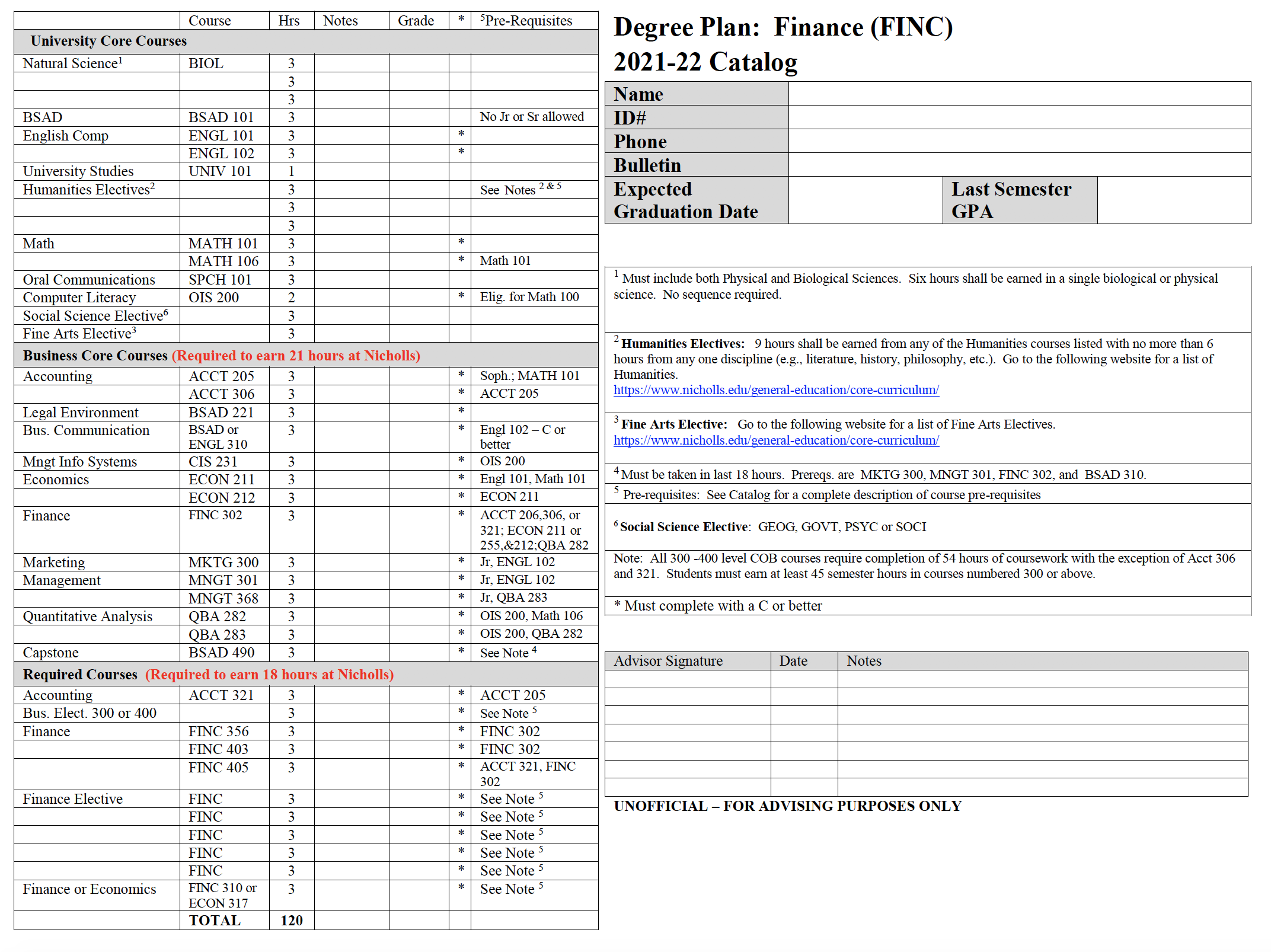

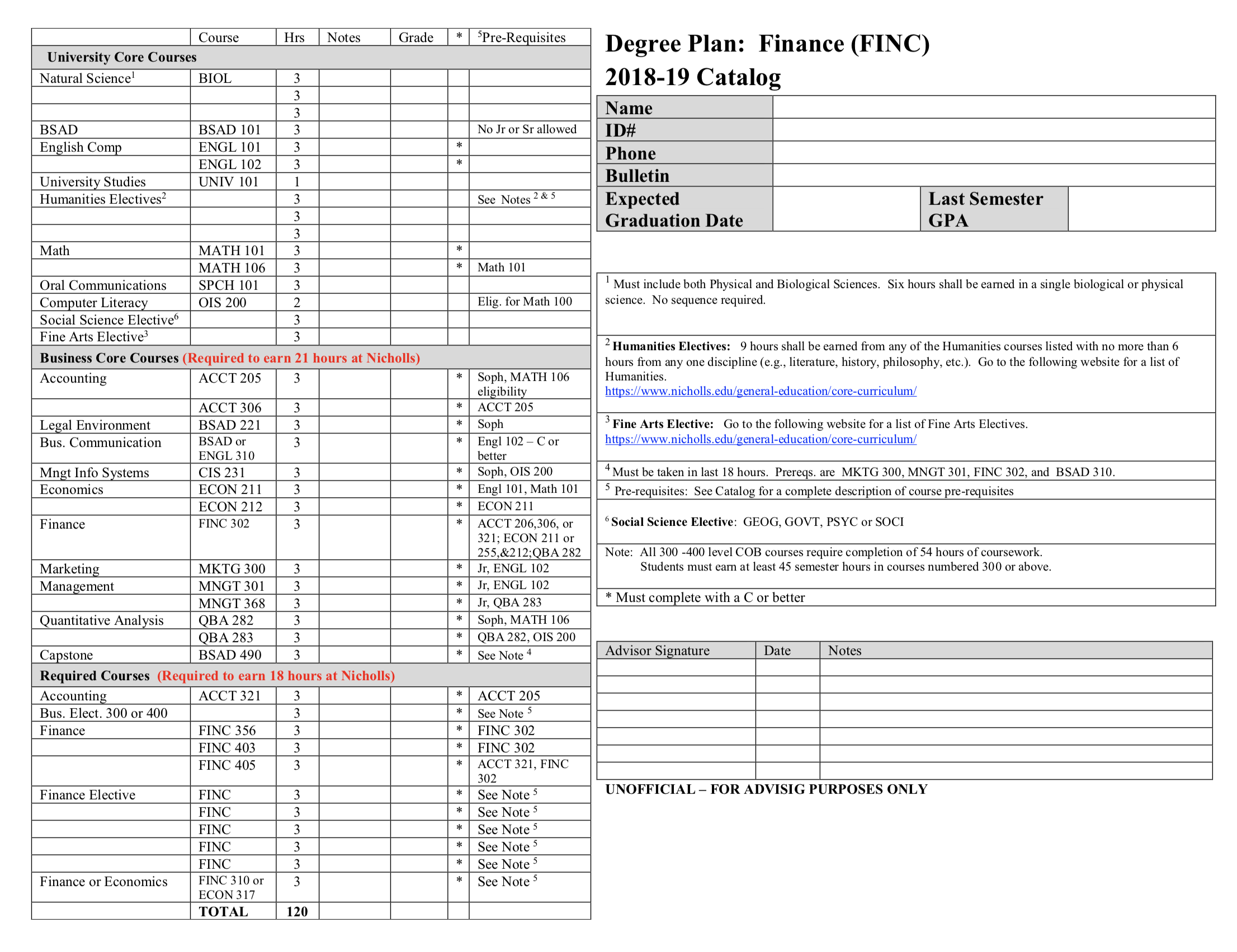

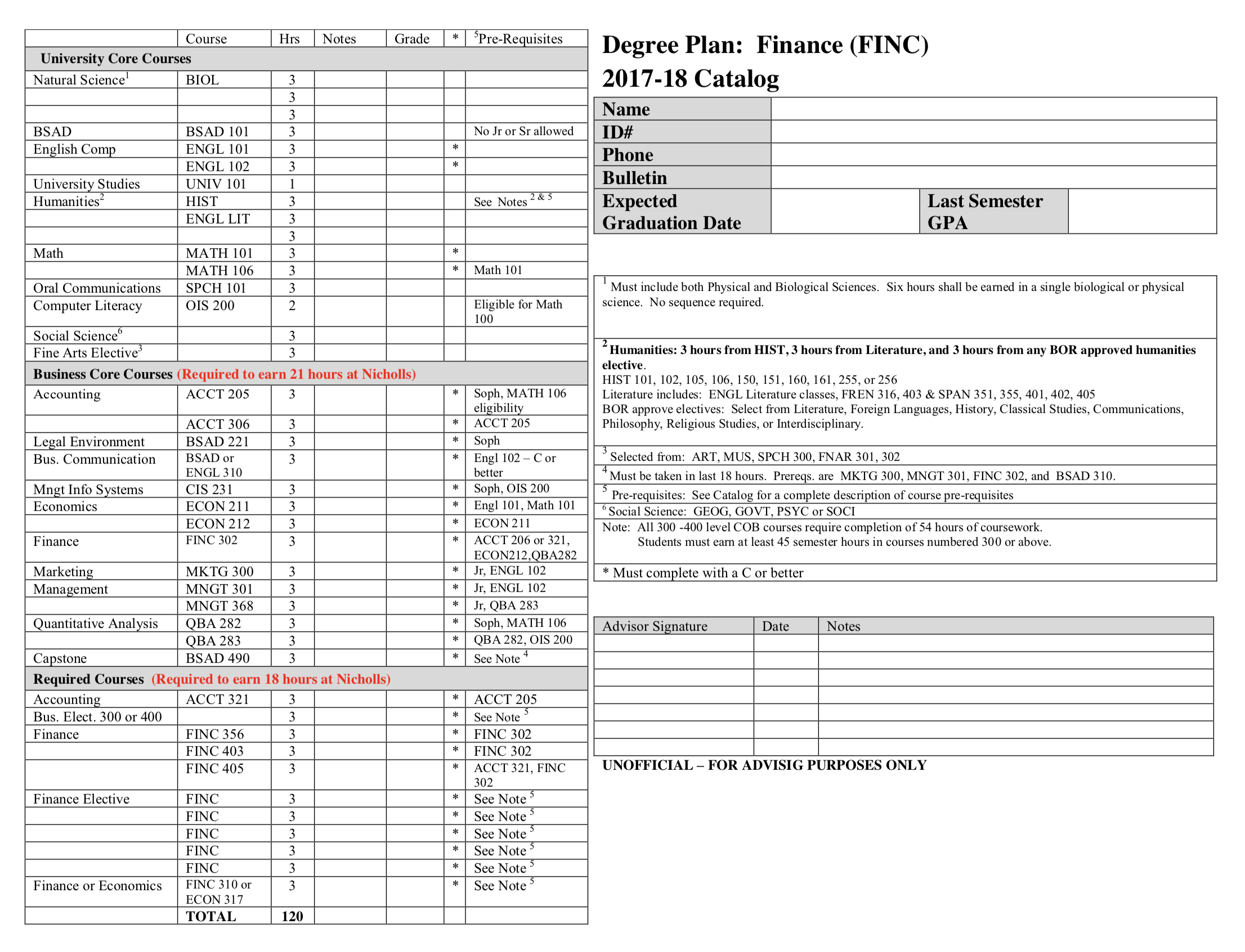

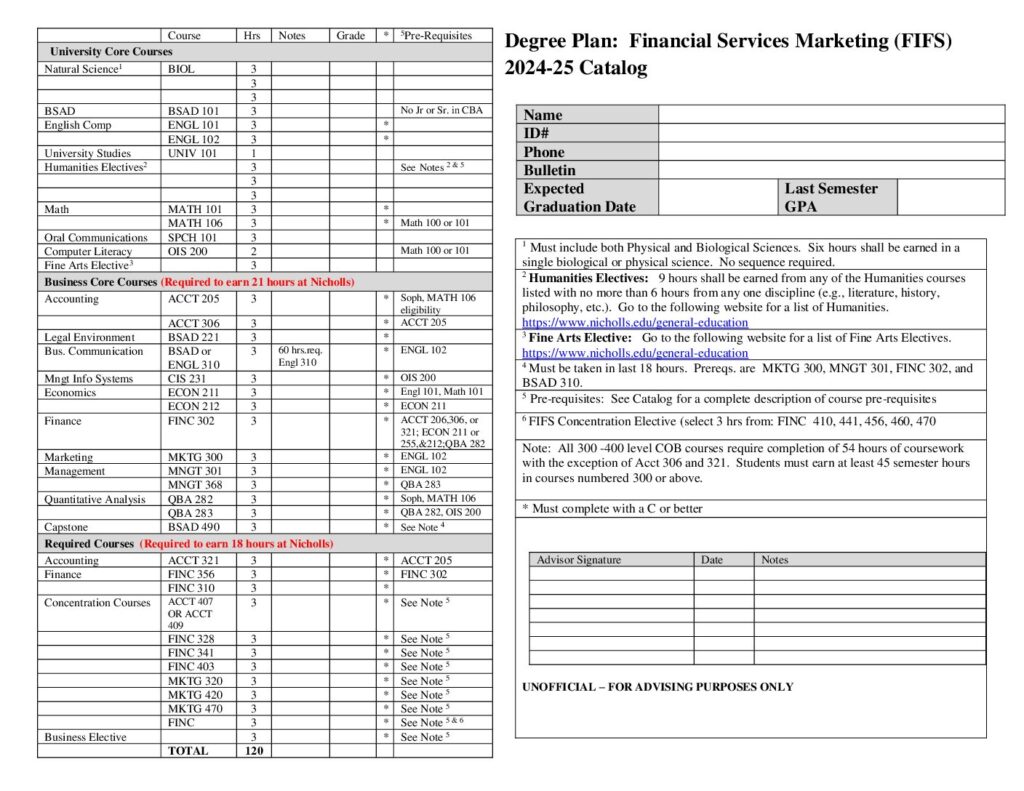

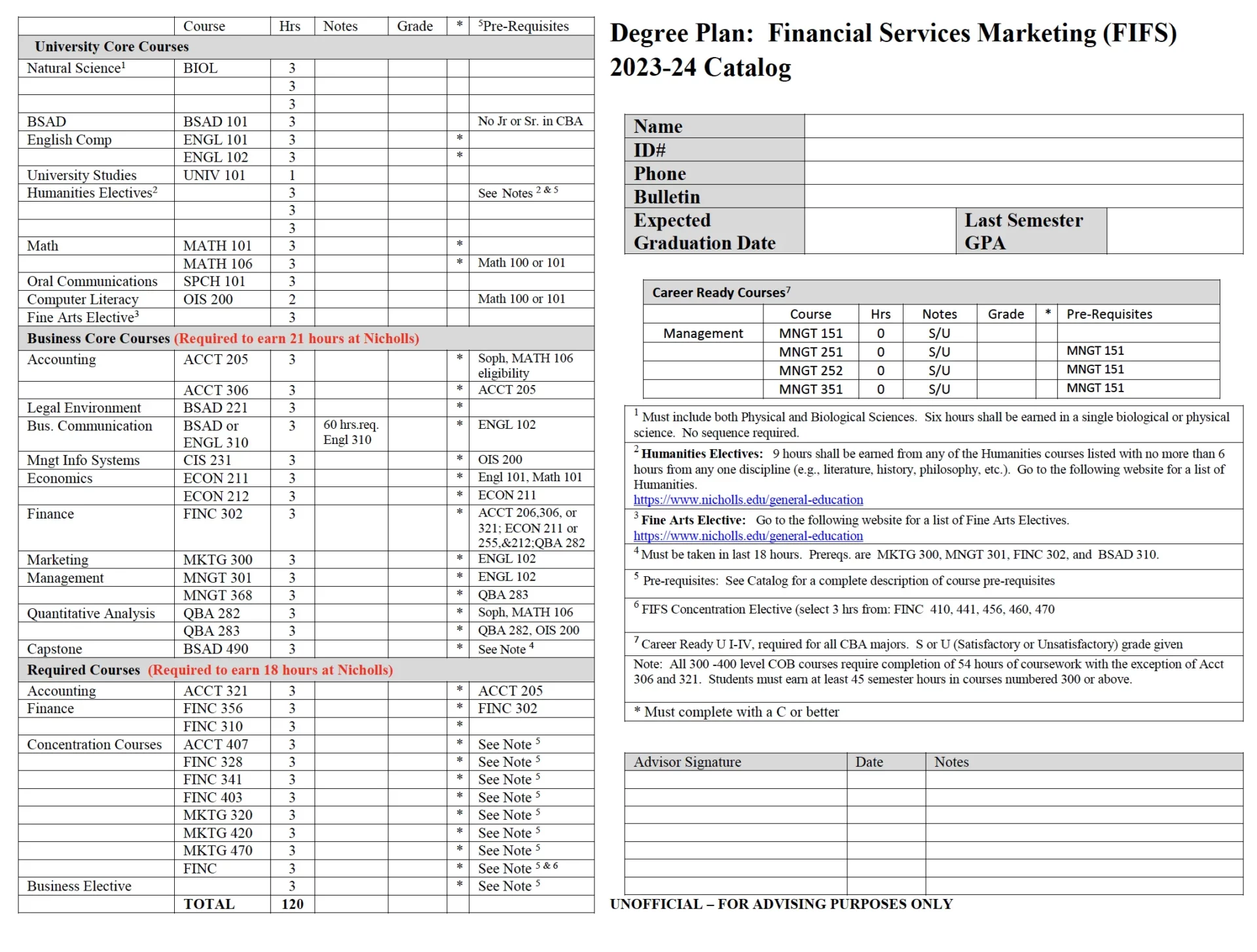

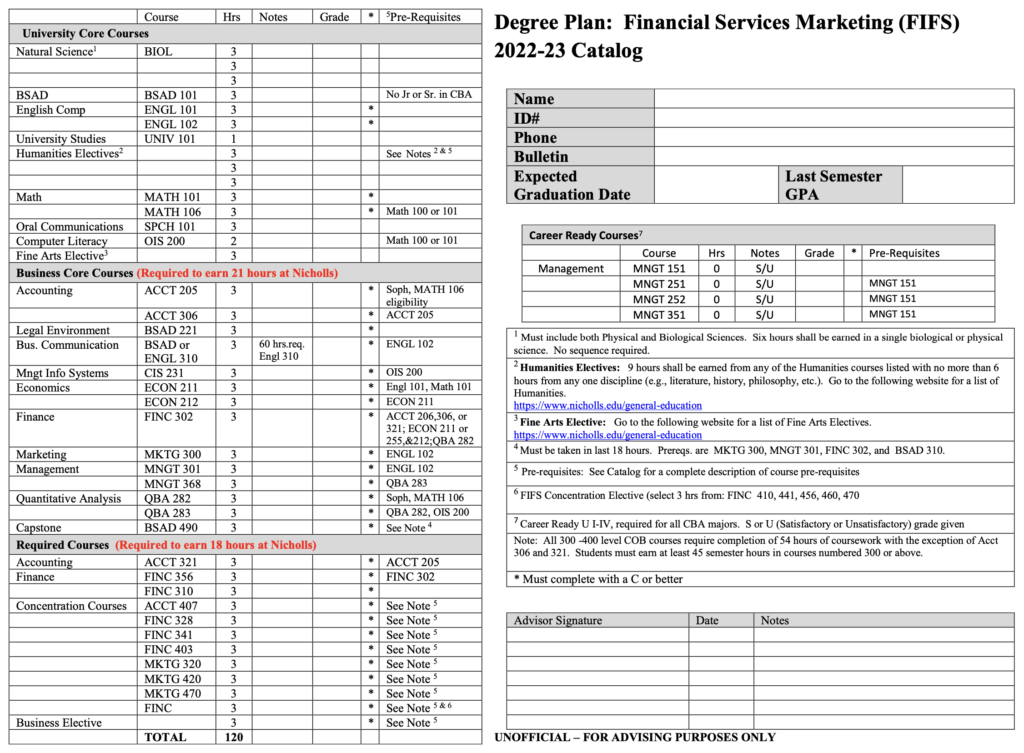

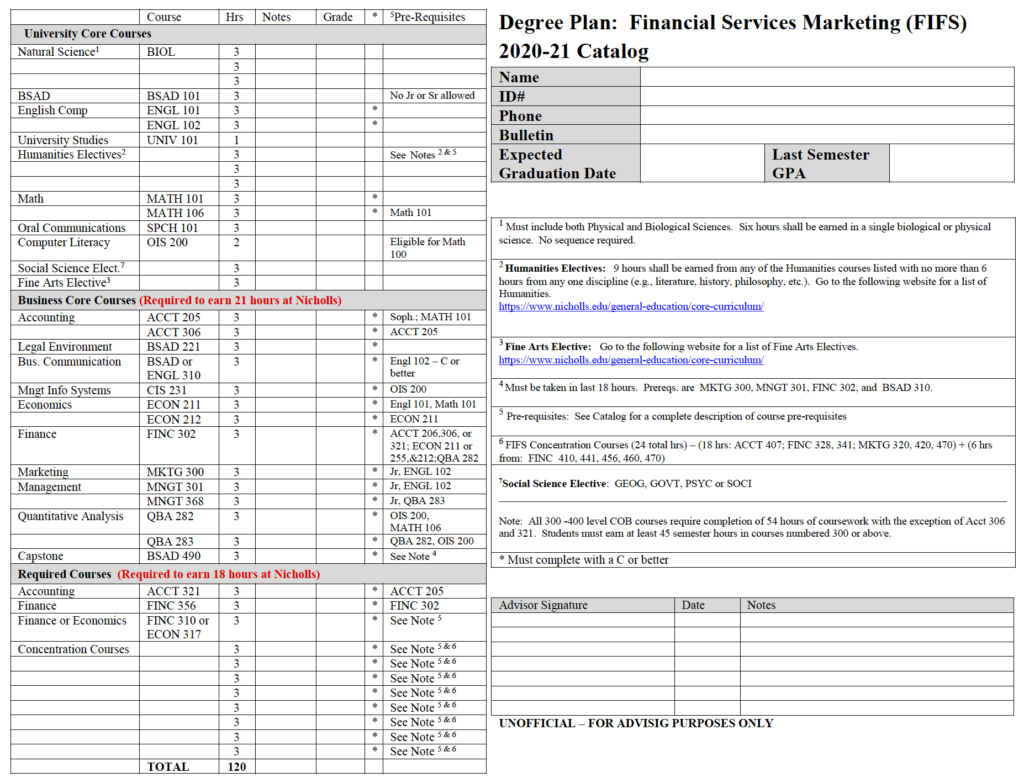

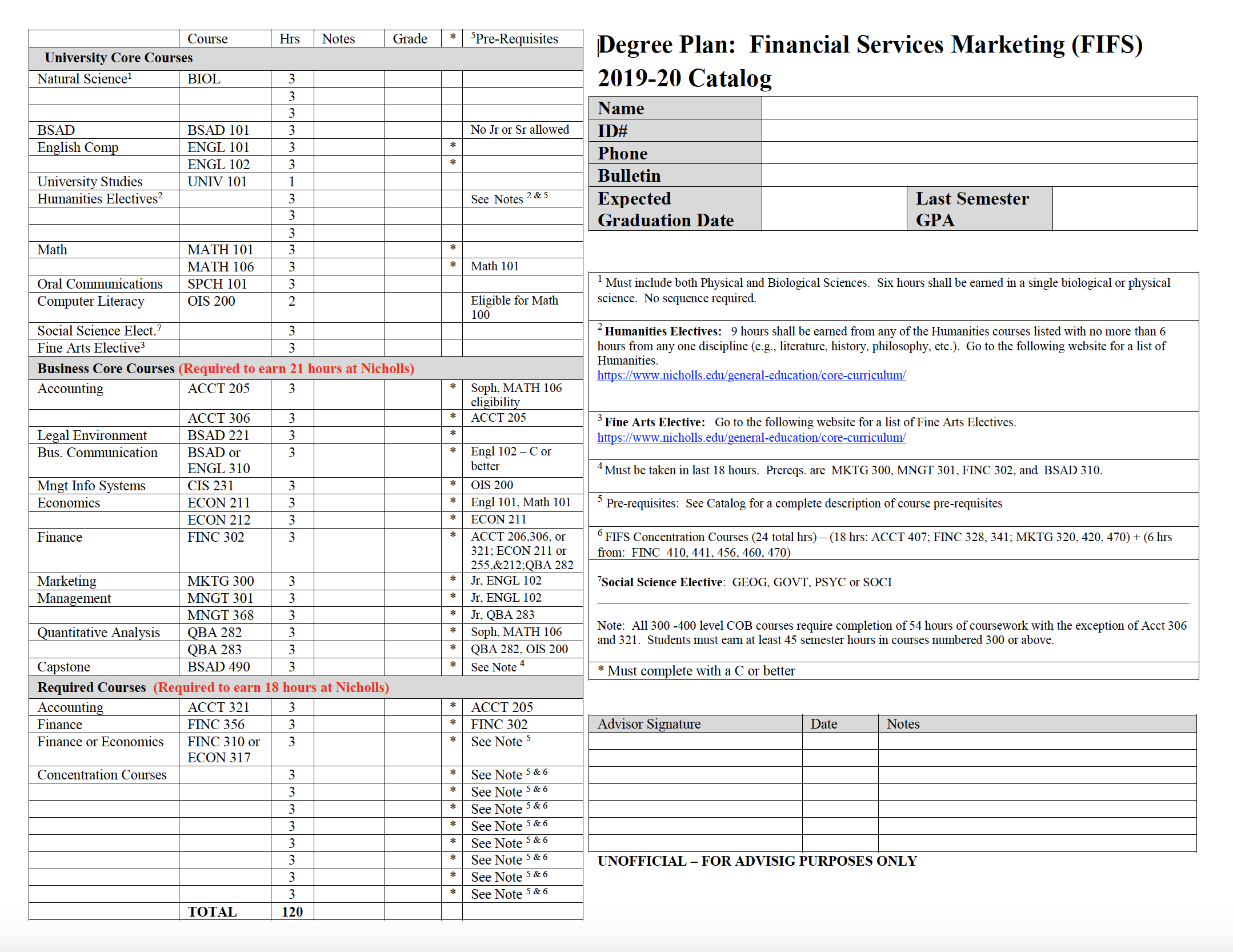

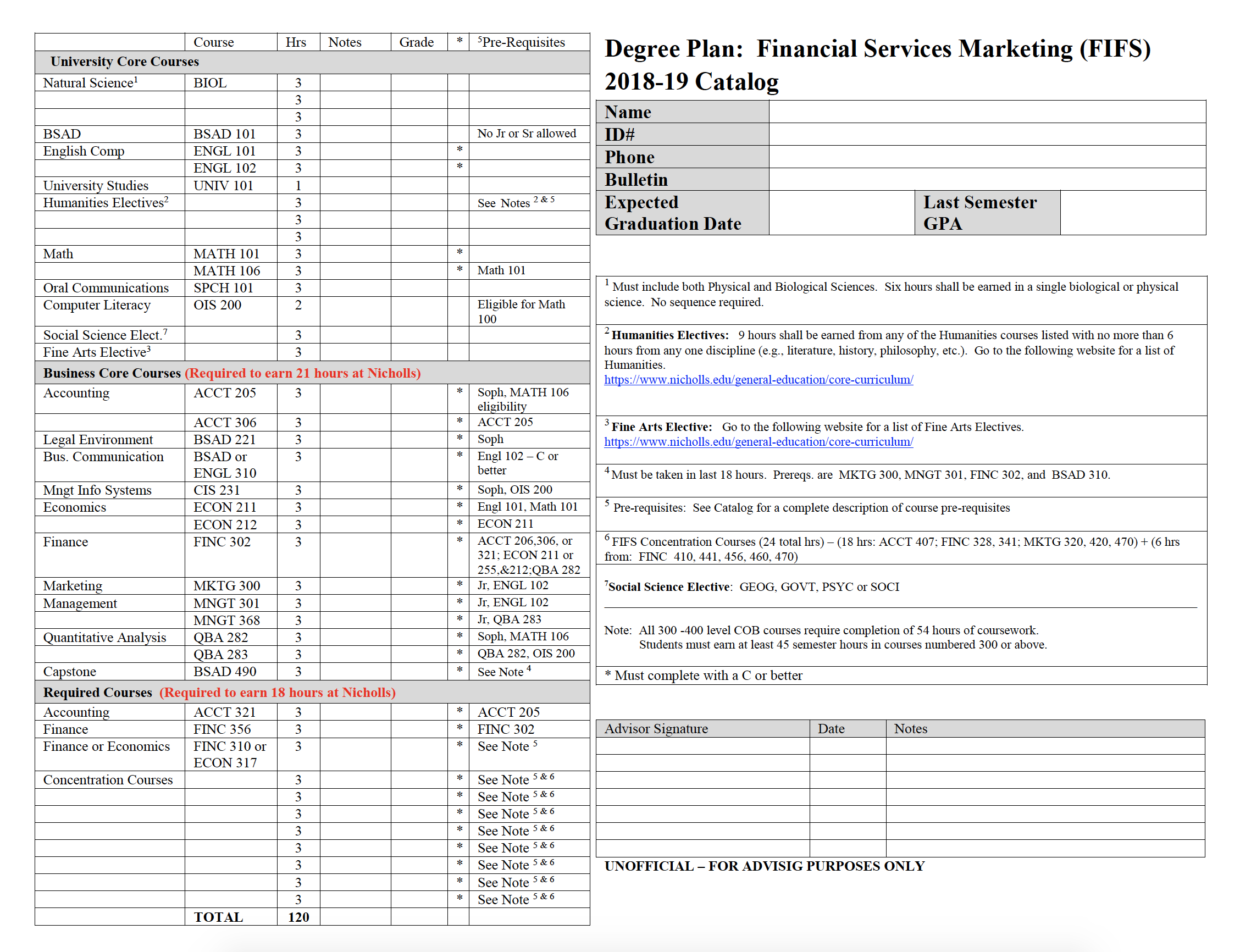

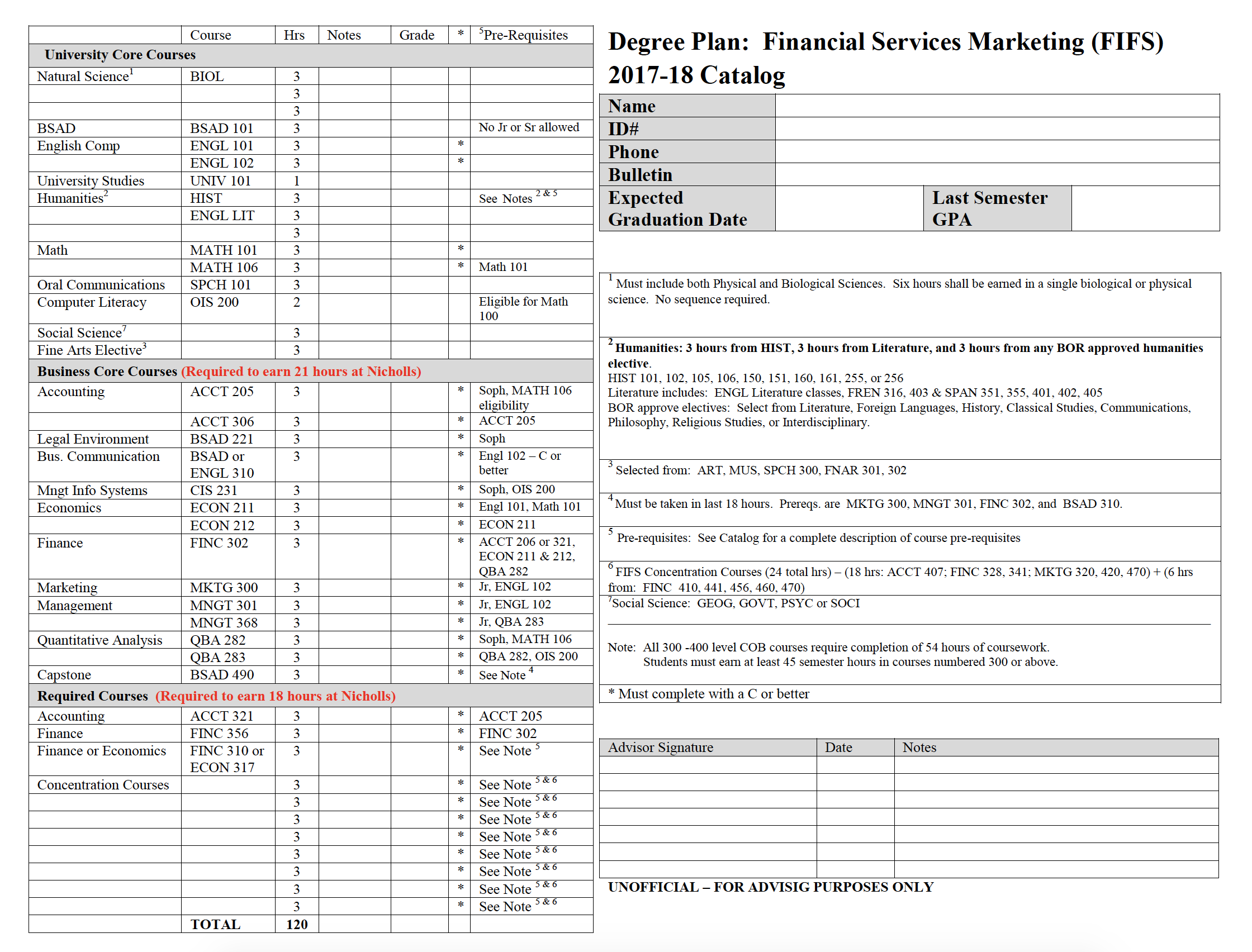

COURSES / DEGREE PLAN

The finance and the financial services marketing degrees have each met the stringent educational requirements set forth by AACSB for a bachelor’s degree in finance. Each curriculum includes senior-level courses in accounting and finance among other general business course requirements. In addition to the respective specific focus, each degree plan is designed to develop student communication, technological, critical thinking and ethical decision-making skills.

Bachelor of Science in Finance. The finance degree program offers a classical and professional educational experience that develops critical thinking abilities through finance and economics courses. The goal of the program is to help students understand the role of money and wealth in the decision-making aspects of modern business. Students are prepared for career opportunities in corporate finance, commercial banking, insurance and investment banking. Based on their career plans, students can take finance electives that specialize in financial institutions, financial planning, corporate finance and/or real estate.

Financial Services Marketing Concentration. Experience the best of both worlds. Trying to decide whether to major in finance or professional sales? At Nicholls State University, you don’t have to choose one over the other. The financial services marketing concentration combines the knowledge of financial markets and institutions with professional selling skills. The curriculum includes senior-level courses in accounting, finance and marketing among other general business course requirements. The program’s students are prepared for careers in financial planning, personal banking, stock brokerage and insurance and real estate sales.

Minor in Finance

To obtain a minor in Finance students must complete FINC 302, 356, 403, and 9 additional hours of 300- or 400-level Finance, for a total of 18 semester hours.

FINC 302. Financial Management. 3-3-0. Prerequisites: C or better in ACCT 206, 306, or 321; ECON 211 or 255, and 212; QBA 282 and completion of 54 hours of non-developmental coursework. Methods and techniques employed to manage the financial resources of a business corporation, with emphasis on financial forecasting, statement analysis, working capital management, capital budgeting, and short term and long term financing. (52.0801)

FINC 310. Financial Markets and Institutions. 3-3-0. Prerequisite: Completion of 54 hours of non-developmental coursework. Theoretical and institutional analysis of money and capital markets and the role of financial intermediaries. Covers interest rate determination; governmental and corporate securities markets; international integration of financial markets; and regulation, organization, and ethics in financial markets and institutions. (52.0803)

FINC 328. Principles of Insurance. 3-3-0. Prerequisites: C or better in QBA 282 and completion of 54 hours of non-developmental coursework. An introductory course to assist students preparing for a career in insurance and to meet the needs of prospective insurance buyers. (52.1701)

FINC 341. Principles of Real Estate. 3-3-0. Prerequisite: Completion of 54 hours of non-developmental coursework. Survey of interest in realty, titles, financing, appraisal, investment criteria for income producing real property, and the principles of purchasing and owning a home. Additional coverage includes brokerage, ethics in real estate, and international markets. This course taken in conjunction with BSAD 221 meets the educational requirements for the Louisiana Real Estate Salesperson’s License. (52.1501)

FINC 356. Investments. 3-3-0. Prerequisite: C or better in FINC 302. People, securities and institutions involved in the securities industry. Alternative investment vehicles within a risk return framework. (52.0807)

FINC 403. Intermediate Financial Management. 3-3-0. Prerequisite: C or better in FINC 302. Theory and current practices in financial management with emphasis on short-term financing. (52.0801)

FINC 405. Financial Statement Analysis. 3-3-0. Prerequisites: C or better in FINC 302, ACCT 321. Use of financial statements to analyze the position of a firm. Topics include analysis techniques and the limitations imposed by generally accepted accounting principles. (52.0801)

FINC 410. Commercial Banking. 3-3-0. Prerequisite: C or better in FINC 302. Management of commercial banks and the banking system. Emphasis on the management of assets and liabilities within a commercial bank and the operation of commercial banks within the current regulatory environment. (52.0803)

FINC 425. Entrepreneurial Finance. 3-3-0. Prerequisite: C or better in FINC 302. Special financial arrangements needed to launch and grow enterprises. Progression of alternatives available to financiers and entrepreneurs, from bootstrapping through public offerings. Valuation of privately held firms. (52.0801)

FINC 441. Real Estate Appraisal. 3-3-0. Prerequisite: C or better in FINC 341. Examines the three traditional approaches to valuation of real estate including value in use to the individual and contemporary thoughts regarding valuation. Computer software used in analysis of residential and income producing properties. (52.1501)

FINC 450. International Finance. 3-3-0. Prerequisite: C or better in FINC 302. International investments; money and banking systems; accounting and marketing in multinational business. (52.0806)

FINC 456. Analytics of Investing. 3-3-0. Prerequisite: C or better in FINC 356. Theory of security valuations of stocks, bonds, warrants, and options. Portfolio theory and modern methods of portfolio construction. (52.0807)

FINC 460. Finance Internship. 3-0-10. Prerequisites: Junior standing and permission of the department head. Supervised practical experience in an approved private or public organization involving work relevant to finance. Only one internship may be counted toward degree. (52.0801)

FINC 470. Financial Planning. 3-3-0. Prerequisites: C or better in FINC 302. Focuses on the theory and practice of financial planning for the purpose of meeting both long and short term financial needs. (52.0807)

FINC 485. Special Topics in Finance. 3-3-0. Prerequisite: Permission of instructor. Selected current topics in Finance. May be repeated once for credit if content differs. (52.0801)

FINC 490. Seminar in Finance. 3-3-0. Prerequisite: Senior standing. Case studies focusing upon integrating financial theory with its application in real world decision making. (52.0801)

FINC 515. Performance and Planning. 3-3-0. Prerequisites: C or better in ACCT 500 and BSAD 501. Prerequisite or Co-requisite: C or better in ECON 500. Provides concepts and analytical framework to measure firm performance and establish short-term plans based on value-based management. (52.0801)

FINC 520. Value-Based Management. 3-3-0. Prerequisite: C or better in FINC 515. Provides the analytical framework to evaluate the long-term strategic investment and financing decisions the firm’s management faces. (52.0801)

STUDENT INFORMATION

As a transfer student, this is the right place for you to continue the pursuit of your academic degree. Because you will enter our college partway through your undergraduate education, please visit the Transfer Student website, which is designed to help students like you.

College can be a harrowing experience for some, and we are there for you as an incoming freshman. From the beginning, during student orientation you will meet with a College of Business adviser who will help you evaluate your schedule to help you succeed in your chosen business profession.

International students have unique cultural experiences that add to the diverse fabric of our academic community. We have students from around the world studying with us and we welcome their contributions.

The College of Business Administration offers two graduate programs to prepare professionals, with or without business degrees, to face uncertain economic conditions, technological changes, culturally diverse workplaces, international issues and the ever-changing political/legal environment.

STUDENT ORGANIZATIONS

Beta Alpha Psi is an international honor society and a scholastic and professional accounting, finance and IS fraternity. Only AACSB-accredited Colleges of Business may have a chapter.

Beta Alpha Psi recognizes outstanding academic achievements in the field of accounting and finance; promotes the study and practice of accounting and finance; provides opportunities for self-development, service, and association among members and practicing accounting and finance professionals; and encourages a sense of ethical, social, and public responsibility.

ACTIVITIES

• declared accounting, finance, or CIS as their major,

• completed two years of college and one upper-level accounting, finance, or CIS course,

• maintained a GPA of at least 3.0 in upper-level accounting, finance, or CIS courses and

• an overall GPA of at least 3.0 or GPA of 3.25 or better on the most recent 30 hours

BAP Officers 2022-2023

President – Clara Soriano-Jimenez

Vice President – Madison Robichaux

Secretary – Saadi Thibodaux

Treasurer – Kylie Robichaux

Programming Director – Vacant

Meetings:

8/30

9/20

10/25

11/15

Meetings for Fall 2022 are from 5-6pm in Powell 225

Other events:

TBA-Fall member induction

11/10 – Student Night

Accounting 205 Large Group study sessions:

9/19 Exam 1

9/29 Exam 2

10/27 Exam 3

11/28 Exam 4

Study sessions are from 6-7pm in Powell 213

Faculty Advisor – Samantha Falgout (985) 448-4193, samantha.falgout@nicholls.edu, 129 Powell

STUDENT RESOURCES

Northwestern Mutual Financial Network Scholarship

This scholarship is awarded to a College of Business junior or non-graduating senior. Applicants must have a minimum 2.5 GPA. Recipients are selected based on GPA, activities and financial need. A one-page essay outlining career goals and interest in financial services is required.

Mike Bauer Memorial Scholarship

This scholarship is awarded to outstanding juniors or non-graduating seniors majoring in finance at Nicholls. The Mike Bauer Memorial Scholarship is a fully endowed scholarship and was created by Mr. and Mrs. Mike Bauer in memory of their son, Mike Bauer, who was an economics major at Nicholls. Recipients are selected based on character, academic performance, activities, and financial need. Applicants must have a minimum 2.5 GPA.

Dr. R. Morris Coats Scholarship in Economics and Finance

Dr. R. Morris Coats spent the last 30 years of his academic career as an economics professor in the College of Business. This scholarship was established in his memory and is awarded per year to a full time College of Business student interested in economics and finance. Recipients are selected based on GPA, activities, and financial need. Applicants are required to provide a 1 page essay examining the following topic, “Why is service learning an important part of a college education?”

OTHER SCHOLARSHIP OPPORTUNITIES

The College of Business Administration has several scholarships that are open to all business majors. Click here for a list. Apply online.

Students are encouraged to apply for a variety of other local, state and national scholarships through the Financial Aid Office.

Many students majoring in finance also choose to simultaneously obtain an accounting degree; only the marginal classes associated with the accounting degree must be completed. The additional 30 hours of work can be completed in two semesters. There is much overlap in these two areas of study: accountants prepare the financial information and people in finance use this information to make decisions. Upon graduation, the student receives 2 bachelor’s degrees – one in finance and one in accounting. Furthermore, with 150 hours of credit, the student can sit for the CPA exam. Such an educational path prepares a student to one day serve as an organization’s Chief Financial Officer (CFO). If you are interested in also obtaining a degree in accounting and sitting for the CPA exam, click here for more information.

Students are assigned an academic adviser from within their disciplines and will be their primary source of information regarding academic requirements. Advisers may assist with job placement, as well as provide information about graduate schools and internships. Academic advising usually occurs for a 3 week period in February or March for the upcoming summer and fall semesters; a similar advising period in October/November is devoted for spring advising. A week before the official advising period begins, an appointment sheet will be posted outside your adviser’s office door. Students then sign up for an appointment at a time that is agreeable for both. Advising outside of the predetermined period can be arranged via appointment

If you are a graduating senior, you must schedule an appointment with your adviser.

- Your adviser will have to approve you for graduation by completing a degree plan.

- You will have to submit a completed College of Business Registration Schedule form to your adviser.

- When completing the form, include at least one alternate section of BSAD 490.

- Your adviser will submit your degree plan and COB Registration Schedule Form to the Department of Accounting & Finance Administrative Coordinator.

- The Department Administrative Coordinator will register you into your classes on the first day of registration. The Admin. Coordinator. for Management and Marketing will register you for BSAD 490. She will do her best to get you into your first choice.

- Please see your adviser asap so your registration form can be turned in. Registration by the administrative coordinators is on a first come, first serve basis.

The name of your academic adviser can be found in Banner under General Student Information and will listed as the student’s Primary Adviser. If you are new to our department and don’t yet have a finance or financial services marketing adviser, contact Mrs. Gina Lagrange (985-448-4176, gina.lagrange@nicholls.edu), administrative coordinator for the Department of Accounting and Finance.

Freshmen finance and financial services marketing majors are assigned advisers in the Academic Advising Center for their first year of classes. However, they are also mentored by select CBA faculty to aid with their transition into college life. College of Business mentors are full-time faculty members who were specifically chosen to assist freshmen in achieving their educational and career goals as they progress through their courses. Freshmen should expect to be contacted by their mentors during their first semester; mentors are also listed in Banner as a freshman’s secondary adviser. As students enter their sophomore year, mentors become a student’s academic adviser.

CFA Institute Research Challenge

High achieving finance majors may be eligible to participate in the annual CFA Institute Research Challenge. According to the CFA Institute’s website, this competition “provides university students with hands-on mentoring and intensive training in financial analysis. Students work in teams to research and analyze a publicly traded company — sometimes even meeting face-to-face with company management. Each team writes a research report on their assigned company with a buy, sell, or hold recommendation and may be asked to present and defend their analysis to a panel of industry professionals.” The Nicholls team consists of three to five undergraduate or graduate students selected by the finance faculty and receive credit for FINC 456: Advanced Investments .

Our 2014 CFA student team advanced to the Americas round of the competition in Denver Colorado. Members included Damian Despotovski, Logan Cox, Courtney Dupre, Huong-Tra Nguyen and Dimitry Lebedv.

Community Bank Case Study Competition

Beginning 2017, a team of three to five undergraduate students will be selected by the finance faculty to compete in the Community Bank Case Study Competition. The student team will partner with a local community bank to develop a case study using the bank’s own unique story which addresses questions posed by the Conference of State Bank Supervisors, the sponsor of the competition. Students will write a “brief, up to 25-pages in length that includes a 1-2 page executive summary and up to 10 pages in tables and charts, that thoroughly discusses the case study findings. Student teams must submit a video of no more than 10 minutes that highlights the teams’ case study findings while showcasing the partnered community bank. ” In each of the two years the CBA has participated, the team has placed in the top 15 teams nationally.

CAREERS

The finance and financial services marketing degrees offer many fascinating and rewarding opportunities for young professionals. Employers often contact the department searching for bright and ambitious personnel.

Robert Half International’s 2014 Salary Guide for Accounting and Finance Careers notes that financial analysts and business systems analysts are in high-demand, and that entry-level hiring is also thriving as employers strive to hire people who will grow with the company.

Furthermore, according to the U.S. Labor Statistics’ Occupational Outlook Handbook, here are some of salaries for those in the finance field:

| Finance Career | Median Annual Salary* |

|---|---|

| Actuary | $96,700 |

| Financial Manager | $115,320 |

| Personal Financial Adviser | $81,060 |

| Financial Analyst | $78,620 |

| Securities, Commodities and Financial Services Sales Agents | $72,070 |

There are many careers for those majoring in finance or financial services marketing:

Corporate Finance

- Treasurer

- Financial Analyst

- Credit Manager

- Cash Manager

- Real Estate Officer

- Investor Relation Officer

- Project Manager

Commercial Banking

- Credit Analyst

- Loan Officer

- Branch Manager

- Trust Officer

- Mortgage Banker

Insurance

- Actuary

- Claims Adjuster

- Service Representative

- Loss Control Specialist

- Risk Manager

- Underwriter

Investment Banking

- Securities Issuance

- Mergers and Acquisitions

- Project Finance

- Securities and Currency Trading

- Ratings Analyst

FINANCIAL SERVICES MARKETING CONCENTRATION

- Financial Planner

- Personal Banker

- Stock Broker

- Portfolio Manager

- Insurance Agent or Broker

- Real Estate Agent

- Financial Representative

FACULTY & STAFF

Dr. Kevin Breaux

Dr. Krisandra Guidry

Dr. Makeen Huda

Title: Assistant Professor of Finance

Department: Accounting & Finance

Email: makeen.huda@nicholls.edu

Office Phone: (985) 448-4215

Office Location: 309A Powell Hall

Dr. John Lajaunie

Dr. Shari Lawrence

Mrs. Gina LaGrange

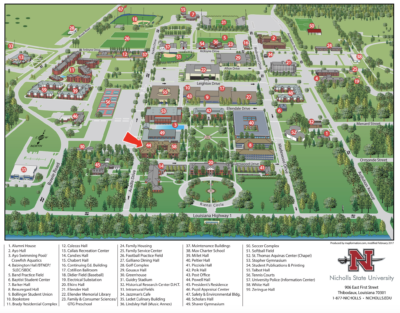

CONTACT INFORMATION:

133 Powell Hall

P. O. Box 2015

Thibodaux, LA 70310