J.B. Falgoust Department of Accounting & Finance

BUSINESS MENU

If you are interested in a career in accounting, the J. B. Falgoust Department of Accounting & Finance is the right place.

Here are a few reasons why you should pursue a degree in accounting at J. B. Falgoust Department of Accounting & Finance at Nicholls:

- Quality. The Nicholls Al Danos College of Business has been accredited by AACSB International for the last 40 years. Hence, our degree plans and accounting courses meet the stringent educational requirements set forth by AACSB for a bachelor’s degree. Our accounting program is also AACSB accredited.

- Student Focused. The department provides opportunities for students to interact with faculty, other students and members of the profession.

- Dedication. The faculty and staff of the department are dedicated to helping you achieve your career goals.

- Employment. The accounting degree offers many fascinating and rewarding careers for young professionals.

Peruse our website to find out more about our curriculum, faculty members, student organizations and career opportunities. Come learn, live and lead with a degree in accounting from the Nicholls Al Danos College of Business Administration.

ACCREDITATION

The J. B. Falgoust Department of Accounting program is accredited by AACSB International — The Association to Advance Collegiate Schools of Business. It has held this accreditation since 2005. The Al Danos College of Business Administration is also accredited by AACSB International.

The J. B. Falgoust Department of Accounting program at Nicholls has constructed its own mission which complements the mission of the college and the university:

The AACSB-accredited J. B. Falgoust Department of Accounting and Finance’s accounting program at Nicholls State University positively impacts the social and economic vitality of the program’s service area and beyond by positioning students to successfully meet workforce development needs as well-educated, responsible, and engaged Accounting professionals.

Our degree plan meets the stringent educational requirements set forth by AACSB for a bachelor’s degree in accounting.

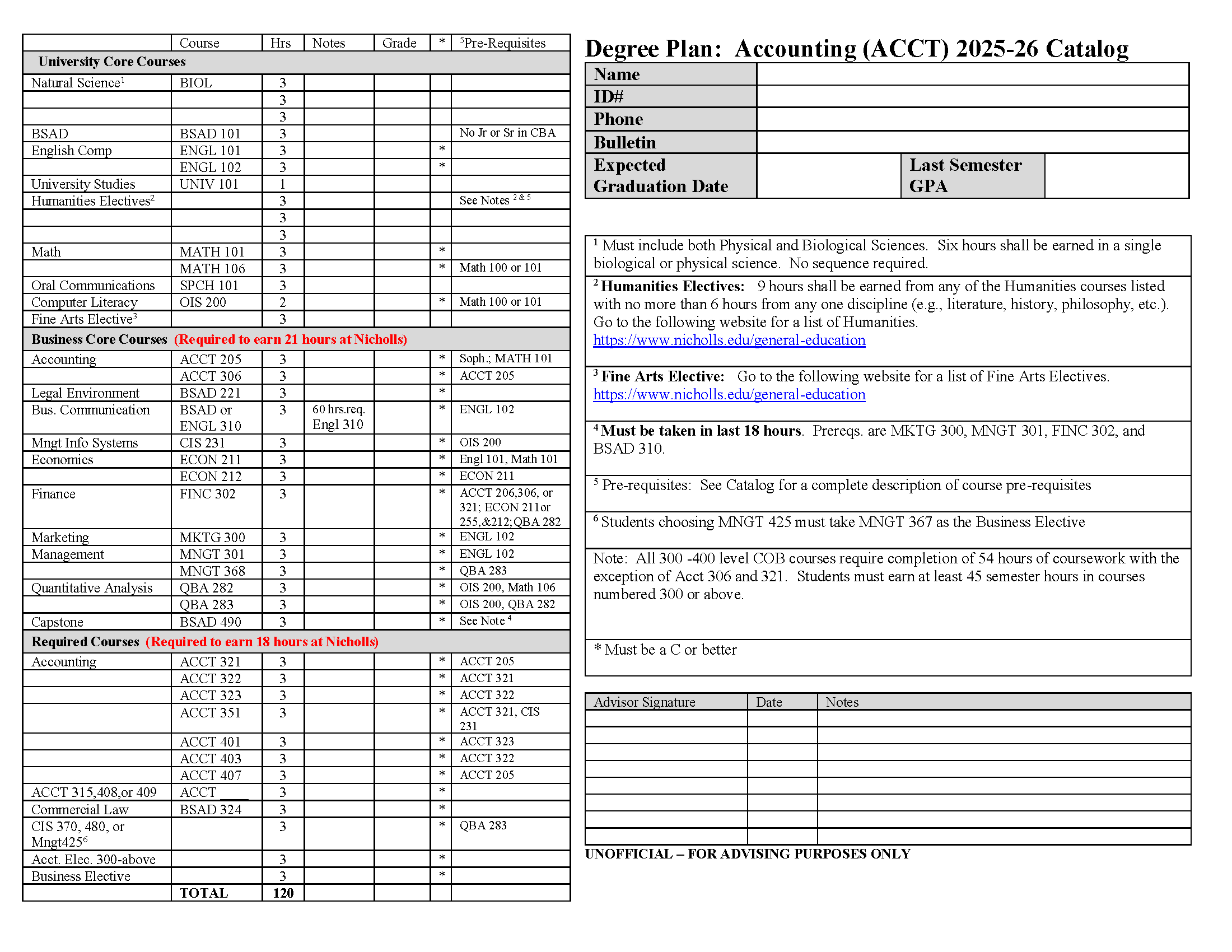

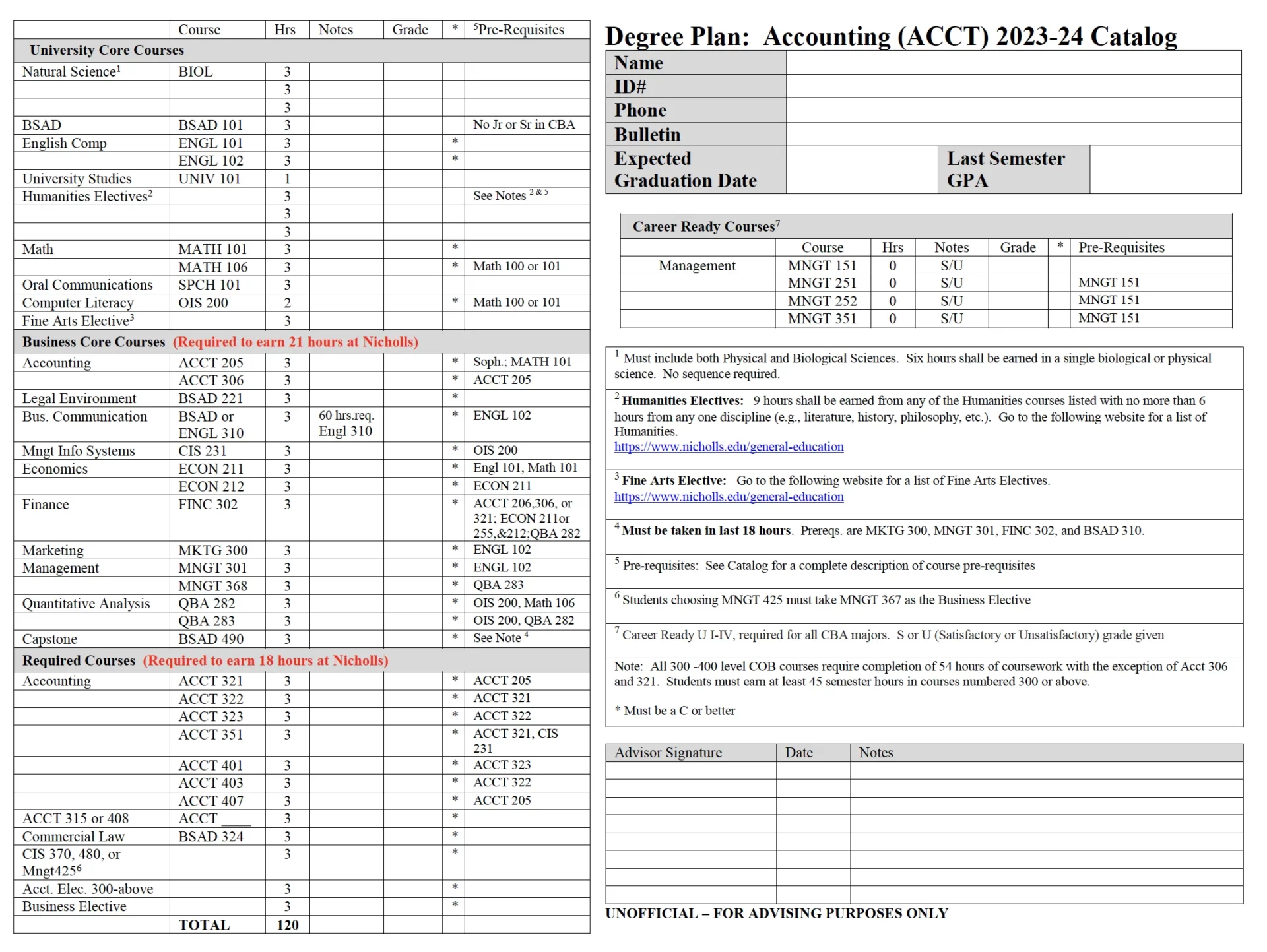

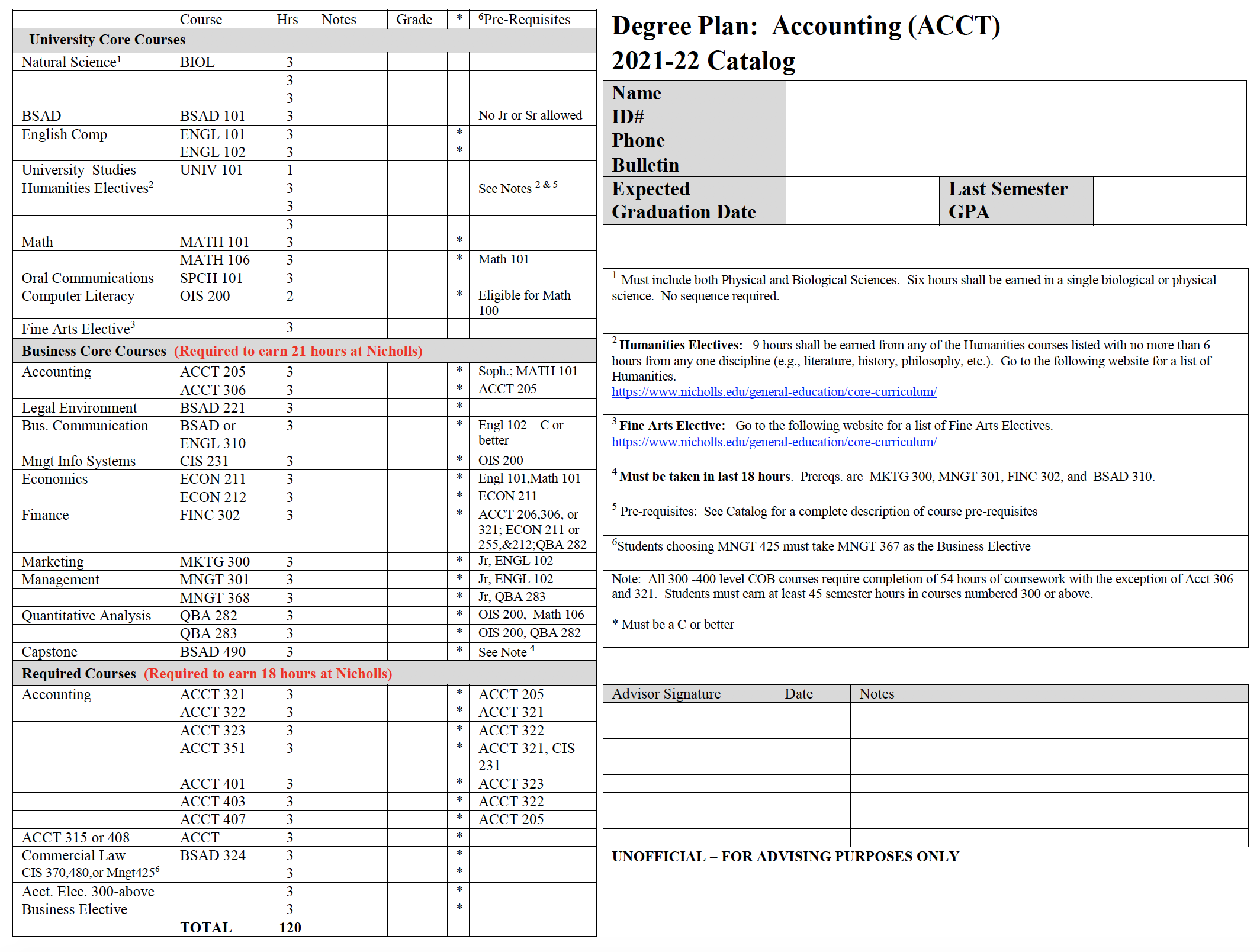

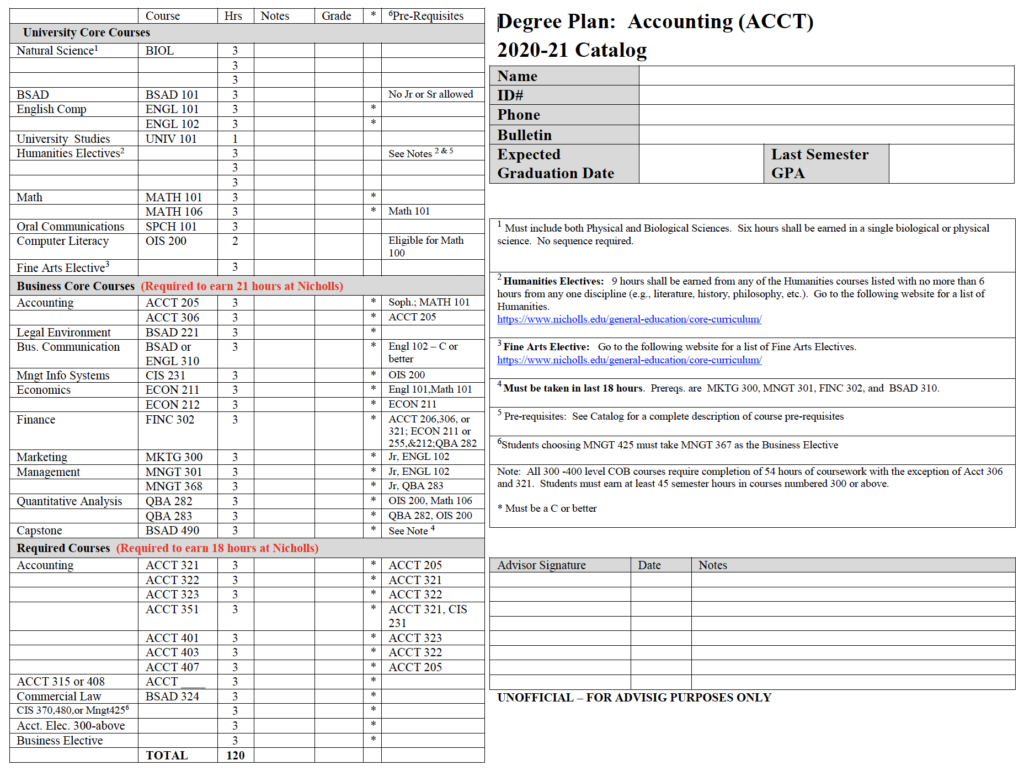

COURSES / DEGREE PLAN

The accounting curriculum provides specialized training for students who intend to enter public, private, governmental or not-for-profit accounting fields. The program also provides prerequisite courses for admission to graduate study.

Nicholls State University accounting graduates are qualified academically to take both the Certified Management Accountant and the Certified Internal Auditor exams. Students completing the 120-hour undergraduate accounting program are awarded a Bachelor of Science in Accounting.

The Louisiana State Board of Public Accountancy requires that an applicant hold a baccalaureate or higher degree and has earned specified hours in accounting and business courses as described in detail below to be eligible to sit for the Uniform Certified Public Accountant Examination. To become licensed, an individual must satisfy the 150-semester hour requirement before December 31st of the fifth calendar year following successful completion of the CPA exam. The additional 30 semester hours can be taken at the undergraduate or graduate level. Students may wish to consider getting a double major while working on the undergraduate accounting degree or pursue a Master of Business Administration (MBA) upon completion of the undergraduate accounting degree. Students should consult with their academic advisor to help determine the best course of action.

The CPA requirements vary from state to state. If a student plans to seek certification in another state, the board of accountancy in that state should be contacted for specific requirements. In Louisiana, contact the State Board of Certified Public Accountants of Louisiana, 601 Poydras Street, Suite 1770, New Orleans, LA 70130, phone number 504-566-1244, fax 504-566-1252.

The transcripts must include the following courses:

| Accounting Courses: | Sem. Hrs. |

| Intermediate accounting | 6 |

| Cost accounting | 3 |

| Income tax | 3 |

| Auditing | 3 |

| Accounting Electives: | |

| (a) from Advanced Financial accounting, Theory or Not-for-Profit accounting/auditing | 3 |

| (b) Accounting courses above the basic and beyond the elementary | 6 |

| (Caution: Internship courses do not satisfy this requirement.) | |

| Total Accounting | 24 |

| Business Courses (other than accounting): | |

| Commercial Law (as it affects accountancy): | 3 |

| Other Business courses | 21 |

| Total Business courses other than accounting | 24 |

| Total Hours | 48 |

All Accounting 300- and 400-level courses require completion of 54 hours of coursework.

ACCT 205. Introduction to Financial Accounting. 3-3-0. Prerequisites: Sophomore standing and MATH 101 (MATH 117 is acceptable for non-business majors with permission of department head). Introduction to corporate financial accounting systems including preparing, interpreting, and using financial statements. [LCCN: CACC 2113] (52.0301)

ACCT 206. Introduction to Managerial Accounting. 3-3-0. Prerequisite: C or better in ACCT 205. Introduction to managerial accounting theories, tools, and concepts. Emphasis is placed on the techniques used to provide information for management decisions. Degree credit will not be given for both Accounting 206 and Accounting 306. [LCCN: CACC 2213] (52.0301)

ACCT 306. Cost Accounting. 3-3-0. Prerequisites: C or better in ACCT 205. Cost concepts, cost behavior, cost techniques, and the uses and limitations of cost data in planning and control. Degree credit will not be given for both Accounting 206 and Accounting 306. As an exception to the College of Business Administration rule related to 300+ level courses, sophomores may enroll in this course. [LCCN: CACC 3113] (52.0301)

ACCT 315. Governmental and Not for Profit Accounting. 3-3-0. Prerequisite: C or better in ACCT 321. Theory and practice of budgeting, financial and managerial accounting, auditing, and reporting for governmental and non profit organizations. (52.0301)

ACCT 321. Intermediate Financial Accounting I. 3-3-0. Prerequisite: C or better in ACCT 205. Theory and application of generally accepted accounting principles with an emphasis on the accounting cycle and the preparation and analysis of the financial statements. As an exception to the College of Business Administration rule related to 300+ level courses, all sophomores may enroll in this course. (52.0301)

ACCT 322. Intermediate Financial Accounting II. 3-3-0. Prerequisite: C or better in ACCT 321. Continuation of ACCT 321 emphasizing accounting for the assets, liabilities, and stockholders’ equity of an entity. (52.0301)

ACCT 323. Intermediate Financial Accounting III. 3-3-0. Prerequisite: C or better in ACCT 322. Continuation of ACCT 322 emphasizing accounting for leases, pensions, income taxes, corporate equity, accounting changes, statement of cash flows, and financial disclosures. (52.0301)

ACCT 351. Accounting Information Systems. 3-3-0. Prerequisites: CIS 231 and C or better in ACCT 321. Systems concepts and their application in the design, implementation, control and audit of accounting information systems, with emphasis on the use of computers in such systems. (52.0301)

ACCT 401. Advanced Accounting. 3-3-0. Prerequisite: C or better in ACCT 323. Basic concepts involved in such complex accounting areas as partnerships, corporate consolidations, and international activities. (52.0301)

ACCT 402. Accounting Internship. 3-0-10. Prerequisites: Junior standing and permission of the department head. Supervised practical experience in an approved private or public organization involving work relevant to accounting. Only one internship may be counted toward degree. Caution: Does not qualify as an accounting elective for CPA exam eligibility. (52.0301)

ACCT 403. Auditing. 3-3-0. Prerequisites: C or better in ACCT 322. Auditing theory and practice; application of generally accepted auditing standards; internal controls-their study and evaluation in EDP systems; professional ethics; audit sampling; special audit engagements; working papers and reports; the solution to auditing problems. [LCCN: CACC 3313] (52.0301)

ACCT 406. Advanced Auditing. 3-3-0. Prerequisite: C or better in ACCT 403. Advanced auditing concepts, practices, and prospective developments in professional and internal auditing. Cases and readings in application of auditing standards, procedures, professional ethics, and legal liability. (52.0301)

ACCT 407. Income Tax Accounting. 3-3-0. Prerequisites: C or better in ACCT 205 and completion of 54 hours of non-developmental coursework. Basic structure and detailed rules of federal income tax laws as they relate to individuals. [LCCN: CACC 3213] (52.0301)

ACCT 408. Advanced Income Tax Accounting. 3-3-0. Prerequisites: C or better in ACCT 205 and ACCT 407. Basic structure and detailed rules of federal income tax laws as they relate to corporations, partnerships, gifts, estates, and trusts. Degree credit will not be given for both Accounting 408 and Accounting 409. [LCCN: CACC 3223] (52.0301)

ACCT 409. Business Taxation. 3-3-0. Prerequisites: C or better in ACCT 206 or ACCT 306, or completion of ACCT 500 with a B or better for graduate students. Business taxation as it impacts decision making on various forms of entities. Not open to Accounting majors. Degree credit will not be given for both ACCT 408 and ACCT 409. (52.0301)

ACCT 485. Special Topics in Accounting. 3-3-0. Prerequisite: Permission of instructor. Selected current topics in Accounting. May be repeated once for credit if content differs. (52.0301)

ACCT 500. Managerial Decision Support. 3-3-0. Prerequisite: ACCT 206 or 306 or equivalent. An integrated study and application of financial and managerial accounting tools and concepts used for planning and control functions in modern organizations. (52.0301)

ACCT 503. Special Topics in Accounting. 3-3-0. Prerequisites: Six hours of accounting and graduate standing. A seminar course focusing on selected current issues in accounting. May be repeated for credit if content differs. (52.0301)

Minor in Accounting

Students interested in pursing a minor in accounting must complete ACCT 205, 321, and 12 additional hours of 300- or 400-level accounting courses. ACCT 206 does not count towards the Accounting minor.

STUDENT INFORMATION

EVENTS: TBA

As a transfer student, this is the right place for you to continue the pursuit of your academic degree. Because you will enter our college partway through your undergraduate education, please visit the Transfer Student website, which is designed to help students like you.

College can be a harrowing experience for some, and we are there for you as an incoming freshman. From the beginning, during student orientation you will meet with a College of Business adviser who will help you evaluate your schedule to help you succeed in your chosen business profession.

International students have unique cultural experiences that add to the diverse fabric of our academic community. We have students from around the world studying with us and we welcome their contributions.

The Al Danos College of Business Administration offers two graduate programs to prepare professionals, with or without business degrees, to face uncertain economic conditions, technological changes, culturally diverse workplaces, international issues and the ever-changing political/legal environment.

STUDENT ORGANIZATIONS

Beta Alpha Psi is an international honor society and a scholastic and professional accounting, finance and IS fraternity. Only AACSB-accredited Colleges of Business may have a chapter.

Beta Alpha Psi recognizes outstanding academic achievements in the field of accounting and finance; promotes the study and practice of accounting and finance; provides opportunities for self-development, service, and association among members and practicing accounting and finance professionals; and encourages a sense of ethical, social, and public responsibility.

ACTIVITIES

• declared accounting, finance, or CIS as their major,

• completed two years of college and one upper-level accounting, finance, or CIS course,

• maintained a GPA of at least 3.0 in upper-level accounting, finance, or CIS courses and

• an overall GPA of at least 3.0 or GPA of 3.25 or better on the most recent 30 hours

BAP Officers 2024-2025

President – Kailey Robert

Vice President – Jaycee Bennett

Secretary – Callie Tregre

Treasurer – Kayden Guidry

Programming Director – Fayth Dubois

Meetings:

2/18/25

3/18/25

4/8/25

4/29/25

Meetings for Spring 2025 are from 5-6pm in Powell 113

Other events:

Accounting 205 Large Group study sessions:

Faculty Advisor – Samantha Falgout (985) 448-4193, samantha.falgout@nicholls.edu, 129 Powell

STUDENT RESOURCES

The following scholarships are available to accounting majors during the spring semeseter of each year. Application forms are available in the J.B. Falgoust Department of Accounting office – 133 Powell Hall .

SOUTH CENTRAL CHAPTER OF LOUISIANA SOCIETY OF CPAs AWARD/ACCOUNTING AND FINANCE DEPARTMENT

Awards are presented to the outstanding accounting graduate from the fall and spring semesters.

SOUTH CENTRAL CHAPTER OF LOUISIANA SOCIETY OF CPAs SCHOLARSHIPS

A scholarship is awarded to an accounting major who has completed at least 12 hours of accounting courses. Applicants must be U.S. citizens and Louisiana residents and have a minimum 3.0 GPA. Scholarships are dependent on South Central Chapter of Louisiana Society of CPAs funding each year.

ASSOCIATION OF GOVERNMENT ACCOUNTANTS SCHOLARSHIPS

Scholarships are awarded to accounting majors who have completed 12 hours of accounting courses. Applicants must be U.S. citizens and Louisiana residents, have a minimum 2.5 GPA and be full-time students eligible to enter their junior year. Scholarships are dependent on Association of Government Accountants funding each year.

BARBARA A. WATTS, CPA, CFE ENDOWED SCHOLARSHIP IN ACCOUNTING

The recipient will be a full time student in the Al Danos College of Business Administration, majoring in Accounting, minimum grade point average of 3.8, and involved in at least one co-curricular activity.

JIMMY N. PONDER, Ph.D., CPA, ENDOWED MEMORIAL SCHOLARSHIP

The recipient will be a full time student in the Al Danos College of Business Administration, majoring in Accounting, minimum grade point average of 3.0, has completed a minimum of 6-hours of Accounting courses, and is actively involved in activities within the Accounting Program (Acct/Finc Club, BAP) and/or the College (NSPIRE, SHRM, Dean’s Student Leadership Advisory Board).

OTHER SCHOLARSHIP OPPORTUNITIES

The Al Danos College of Business Administration has several scholarships that are open to all business majors. Click here for a list. Application forms are available in the Dean’s Office (106 White Hall).

Students are encouraged to apply for a variety of other local, state and national scholarships through the Financial Aid Office.

A Certified Public Accountant must meet various state educational and experience requirements in addition to passing the standardized examination prepared by the American Institute of Certified Public Accountants.

The Louisiana State Board of Public Accountancy requires that an applicant hold a baccalaureate or higher degree and has earned specified hours in accounting and business courses as described in detail below to be eligible to sit for the Uniform Certified Public Accountant Examination. To become licensed, an individual must satisfy the 150-semester hour requirement before December 31st of the fifth calendar year following successful completion of the CPA exam. The additional 30 semester hours can be taken at the undergraduate or graduate level. Students may wish to consider getting a double major while working on the undergraduate accounting degree or pursue a Master of Business Administration (MBA) upon completion of the undergraduate accounting degree. Students should consult with their academic advisor to help determine the best course of action. The transcripts must include the following courses:

| Accounting Courses: | Sem. Hrs. |

| Intermediate accounting | 6 |

| Cost accounting | 3 |

| Income tax | 3 |

| Auditing | 3 |

| Accounting Electives: | |

| (a) from Advanced Financial accounting, Theory or Not-for-Profit accounting/auditing | 3 |

| (b) Accounting courses above the basic and beyond the elementary | 6 |

| (Caution: Internship courses do not satisfy this requirement.) | |

| Total Accounting | 24 |

| Business Courses (other than accounting): | |

| Commercial Law (as it affects accountancy): | 3 |

| Other Business courses | 21 |

| Total Business courses other than accounting | 24 |

| Total Hours | 48 |

The CPA requirements vary from state to state. If a student plans to seek certification in another state, the board of accountancy in that state should be contacted for specific requirements. In Louisiana, contact the State Board of Certified Public Accountants of Louisiana, 601 Poydras Street, Suite 1770, New Orleans, LA 70130, phone number 504-566-1244, fax 504-566-1252.

For CPA Review courses, visit these links:

Students are assigned an academic adviser from within their disciplines who will be their primary source of information regarding academic requirements. Advisers may assist with job placement, as well as provide information about graduate schools and internships. Academic advising usually occurs for a 3 week period in February or March for the upcoming summer and fall semesters; a similar advising period in October/November is devoted for spring advising. A week before the official advising period begins, an appointment sheet will be posted outside your adviser’s office door. Students then sign up for an appointment at a time that is agreeable for both. Advising outside of the predetermined period can be arranged via appointment.

If you are a graduating senior, you must schedule an appointment with your adviser.

- Your adviser will have to approve you for graduation by completing a degree plan.

- You will have to submit a completed Al Danos College of Business Registration Schedule form to your adviser.

- When completing the form, include at least one alternate section of BSAD 490.

- Your adviser will submit your degree plan and COB Registration Schedule Form to the Department of Accounting & Finance Administrative Coordinator.

- The Department Administrative Coordinator will register you into your classes on the first day of registration. The Admin. Coordinator. for Management and Marketing will register you for BSAD 490. She will do her best to get you into your first choice.

- Please see your adviser asap so your registration form can be turned in. Registration by the administrative coordinators is on a first come, first serve basis.

The name of your academic adviser can be found in Banner under General Student Information and will listed as the student’s Primary Adviser. If you are new to our department and don’t yet have an accounting adviser, contact Mrs. Gina Lagrange (985-448-4176, gina.lagrange@nicholls.edu), administrative coordinator for the Department of Accounting and Finance.

Freshmen accounting majors are assigned advisers in the Academic Advising Center for their first year of classes. However, they are also mentored by select CBA faculty to aid with their transition into college life. Al Danos College of Business mentors are full-time faculty members who were specifically chosen to assist freshmen in achieving their educational and career goals as they progress through their courses. Freshmen should expect to be contacted by their mentors during their first semester; mentors are also listed in Banner as a freshman’s secondary adviser. As students enter their sophomore year, mentors become a student’s academic adviser.

JOB SEARCH

Nicholls State University Career Services

PROFESSIONAL ORGANIZATIONS

American Institute of Certified Public Accountants

American Accounting Association

Association of Government Accountants

Certified Financial Planner Board of Standards

Financial Accounting Standards Board

Institute of Internal Auditors

Institute of Management Accountants

Society of Louisiana Certified Public Accountants

CPA FIRMS

Darnall, Sikes, Gardes & Frederick

CAREERS

Accounting was ranked by CNN Money as one of the top three hottest college degrees for getting hired. Accounting graduates are prepared for careers in public, managerial and governmental or not-for-profit accounting (if you are currently looking for a position, contact the department office, Accounting and Finance in 133 Powell or visit the department’s facebook page at https://www.facebook.com/NichollsAccountingFinance).

PUBLIC ACCOUNTING

Public accounting firms (CPA firms) offer professional accounting and related services for a fee to clients such as corporations, partnerships, organizations, governmental entities and individuals. These services tend to fall into three broad categories: external auditing, tax services and management advisory (consulting) services.

External Auditing: Users of financial information, such as bankers and investors (the external users), are more confident about the fairness of a company’s financial statements when a team of independent auditors from a CPA firm have performed a detailed examination of a company’s accounting records.

Tax Services: Accountants also provide expert advice on tax planning to both individual and business clients. The objective of tax planning is to consider the effect that taxes have on various business decisions. Also, accountants prepare federal, state and local tax returns.

Consulting Services: Management advisory services comprise the fastest growing area for many accounting firms. Some of the services offered to clients include financial planning, accounting systems design, inventory control, budgeting, personnel administration and internal auditing.

MANAGEMENT ACCOUNTING

In contrast to public accountants who work in firms that provide services for many different clients, management accountants are employees of and provide accounting services for a single company or organization. Careers in management accounting can be both very challenging and financially rewarding. Management accountants may specialize in internal auditing, cost accounting, budgeting, information systems design, financial accounting and taxation.

GOVERNMENTAL OR NOT- FOR-PROFIT ACCOUNTING

Another career option for professional accountants is with governmental entities such as federal, state and city governments; or other not-for-profit organizations such as churches, hospitals, charities and schools. While governmental or not-for-profit accountants often work in a regulatory environment, frequently their job duties relate to the management of the receipt and disbursement of funds.

Degreed accountants may earn one or more professional designations, depending upon their career path and personal interests. Among the several designations available are the CPA, CMA, and CIA.

Certified Public Accountant:

A CPA must meet various state educational and experience requirements in addition to passing the standardized examination prepared by the American Institute of Certified Public Accountants.

Certified Management Accountant:

A CMA candidate must pass a series of standardized examinations prepared by the Institute of Management Accountants and meet other educational and experience requirements.

Certified Internal Auditor:

The Institute of Internal Auditors grants the CIA certificate to accountants after they have successfully completed the IIA examination and have met other requirements.

Nicholls State University accounting graduates are qualified academically to take both the CMA and the CIA exams. Students completing the 121-hour undergraduate accounting program are awarded a Bachelor of Science in Accounting. Upon completion of an additional 29 hours of study, the student meets the educational requirement of 150 hours currently set forth by the Louisiana State Board of Certified Public Accountants to take the CPA exam. Students are strongly encouraged to complete a double major or the Master of Business Administration program to satisfy the additional hours.

ACCOUNTING PROFESSIONALS

In addition to the accounting faculty, the Accounting Advisory Board participates in the planning and evaluation of the Nicholls State University accounting program. The advisory board is composed of a diverse group of individuals from public, industry and governmental accounting. To represent the accounting majors, current Nicholls students serve on the advisory board. The current make-up of the board is as follows:

Jodie Arceneaux, CPA, Director

LaPorte CPAs and Business Advisors

Tara Berger, CPA, Operations Manager

Amelia Belle Casino

Derek Boudreaux, VP Finance and Accounting

Montco Oilfield Solutions

Justin Bourgeois, CPA, Associate Tax Director

Postlethwaite and Netterville

Travis Brown, Senior Director Field Business Planning,

Charter Communications

Nolan Falgout, III, Chief Financial Officer

First American Bank & Trust

Don Gaudet, CPA

Ron Gitz, CPA Executive Director

Society of LA CPAs

Lauren Hebert, CPA

Darnall, Sikes, and Frederick

Henry Johnson, CPA, Corporate Controller

Grand Isle Shipyard

Bryce Ledet, CPA

Bryce Ledet, CPA – A Professional Corporation

Kandace Mauldin, CPA, CFO

Terrebonne Parish Consolidated Government

Barry Melancon, CPA , President and CEO

American Institute of CPAs

Greg Piazza, Manager of Business Development

Ryan

Tony Ruiz, CPA

Diez, Dupuy & Ruiz, LLC

Charles Theriot, CPA

Charles C. Theriot & Company

STUDENT MEMBERS: Student members are generally selected to serve on the advisory board during their sophomore or junior year. This allows them time to become involved within the Department of Accounting and Finance and to become knowledgeable about the curriculum.

FACULTY & STAFF

Dr. Kevin Breaux

Dr. Michael Chiasson

Dr. Tony Chu

Dr. Samantha Falgout

Department: Accounting & Finance

Dr. Stephanie Merrell

Mrs. Sunny Downer

CONTACT INFORMATION:

133 Powell Hall

P. O. Box 2015

Thibodaux, LA 70310